As we move deeper into fall, the Anne Arundel County housing market shows some interesting trends in both inventory levels and pricing. Here’s a breakdown of the current market conditions and how they compare to previous years.

Active Listings Drop as We Enter the Holiday Season

The total number of active listings in Anne Arundel County has dropped to 734 in November, marking a 10% decrease from last month. This seasonal dip is expected, as many sellers opt to wait until spring, historically the most active season for new listings. Despite the drop, inventory is still higher than this time last year, showing an upward trend in housing availability over the past two years.

Inventory Trends: 2024 Compared to Previous Years

Looking at inventory levels by year, 2024 has consistently shown higher listings than 2022 and 2023, peaking in summer before starting the usual year-end decline. This cyclical pattern highlights a balanced market where buyers still have a fair number of options. Annapolis, Glen Burnie, and Pasadena lead in available listings, with Annapolis offering 166 homes, Glen Burnie at 102, and Pasadena with 73.

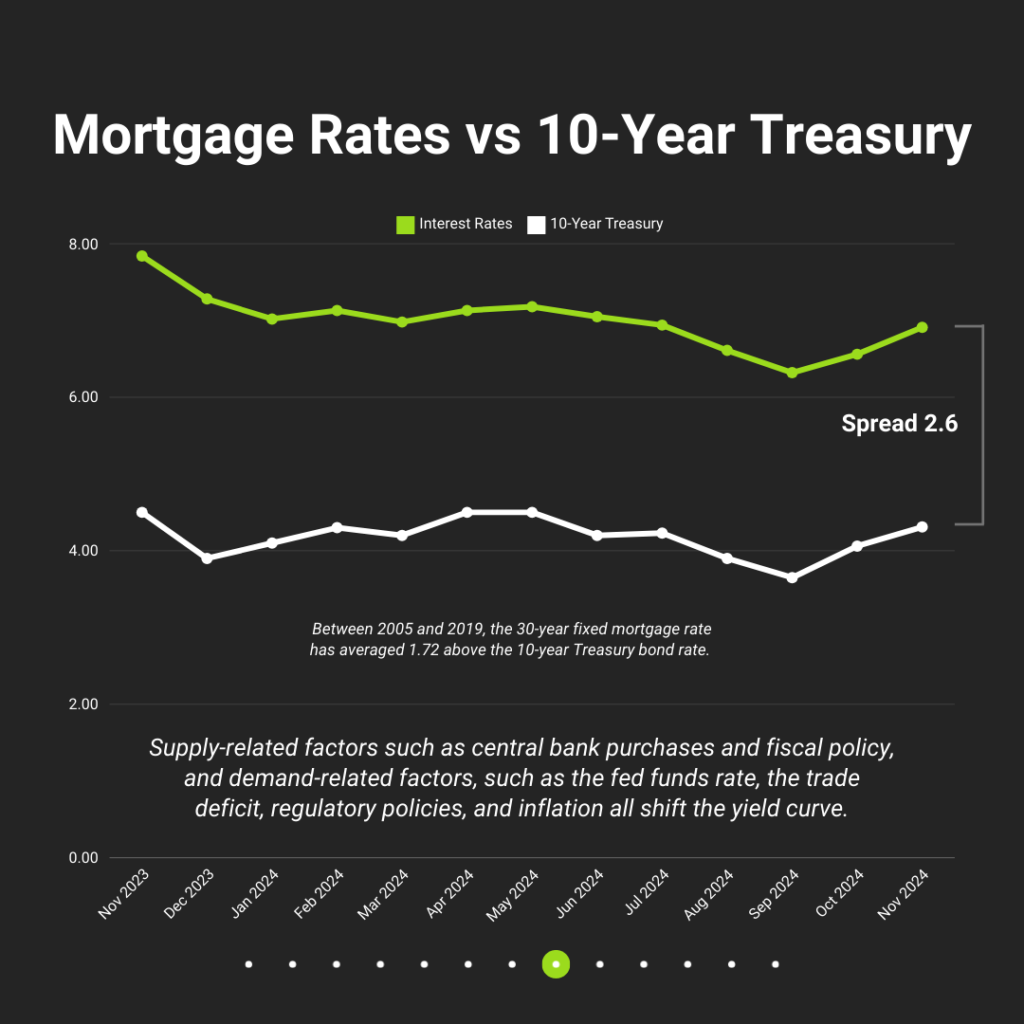

Mortgage Rates Hold Steady But Remain Elevated

Average mortgage rates for a 30-year fixed loan are holding steady at 6.91%, unchanged over the past week. When compared to the 10-Year Treasury rate, we see a current spread of 2.6 points, which is above the historical average spread of 1.72 points seen from 2005 to 2019. This elevated spread indicates a cautious lending environment, possibly due to economic uncertainties, inflation, and Federal Reserve policies.

Home Prices See Modest Year-Over-Year Increase

The median sales price in Anne Arundel County is now at $498,500, reflecting a 2.3% increase year-over-year. This steady rise in prices is aligned with national trends, where demand remains high, even as inventory slowly rises. Home values have shown resilience throughout 2024, maintaining higher price points than in 2022 and 2023.

Days on Market by Property Type

Properties are spending slightly longer on the market this season. Detached homes now average 10 days on market, while townhomes are seeing a quicker turnover at around 6 days. Condos, however, are lingering the longest, with a median of 11 days on market. These variations highlight differing demand levels across property types, with detached homes remaining the most popular among buyers.

Affordability: Payment Comparison at Different Interest Rates

With current interest rates at 6.91%, the monthly mortgage payment on a $500,000 loan would be approximately $3,796. This is significantly higher than the monthly payment of $3,468 at a lower rate of 5.91% but more affordable than a 7.91% rate, which would push the monthly cost to $4,137. These comparisons underscore the impact of rising interest rates on home affordability, making it essential for buyers to monitor rates closely.

The Anne Arundel County housing market is experiencing a seasonal slowdown, but pricing trends suggest continued demand stability. As we look toward the winter months, buyers and sellers alike can benefit from understanding these patterns. Buyers should watch interest rates carefully, while sellers may want to prepare for an active spring market.

For personalized advice or to discuss market trends in more detail, don’t hesitate to reach out. Whether you’re buying or selling, navigating this market with an experienced real estate agent can make all the difference.