The Anne Arundel County housing market shows clear signs of a seasonal shift as we enter peak spring. After three years of tightening inventory and accelerating prices, April’s data points toward a modest rebalancing between buyers and sellers.

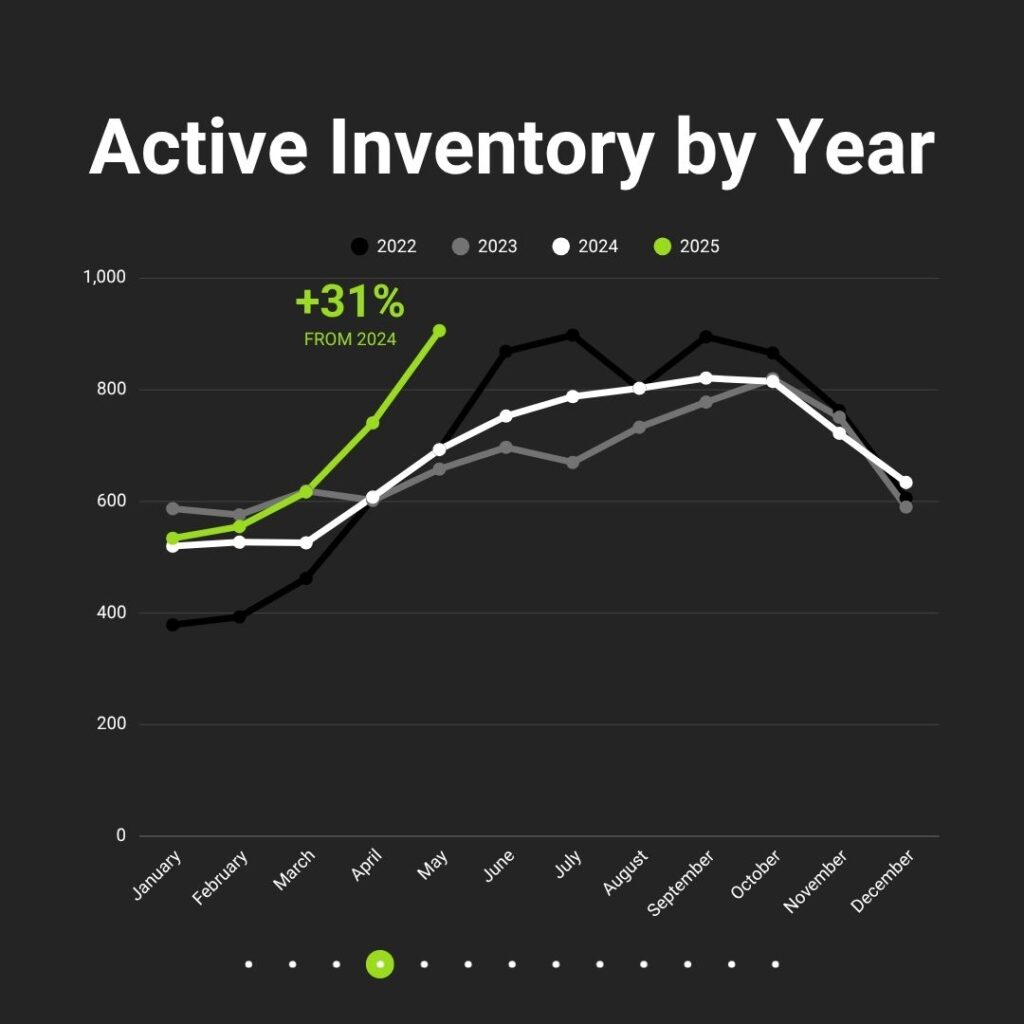

Inventory Remains Elevated

- 906 active listings countywide in May—a 22 percent rise from April and 31 percent above May 2024.

- In Pasadena, supply jumped from 72 to 112 homes, a 55 percent monthly surge.

- Annapolis leads with 189 listings. Pasadena follows at 112, then Glen Burnie at 108. Other cities: Odenton (47), Severna Park (34), Severn (38), Arnold (33) and Crownsville (22).

Moreover, inventory typically peaks in late spring before tapering off in summer. In prior years, May listings hovered near 600–650 homes. This year’s jump toward 900+ signals a welcome opportunity for buyers.

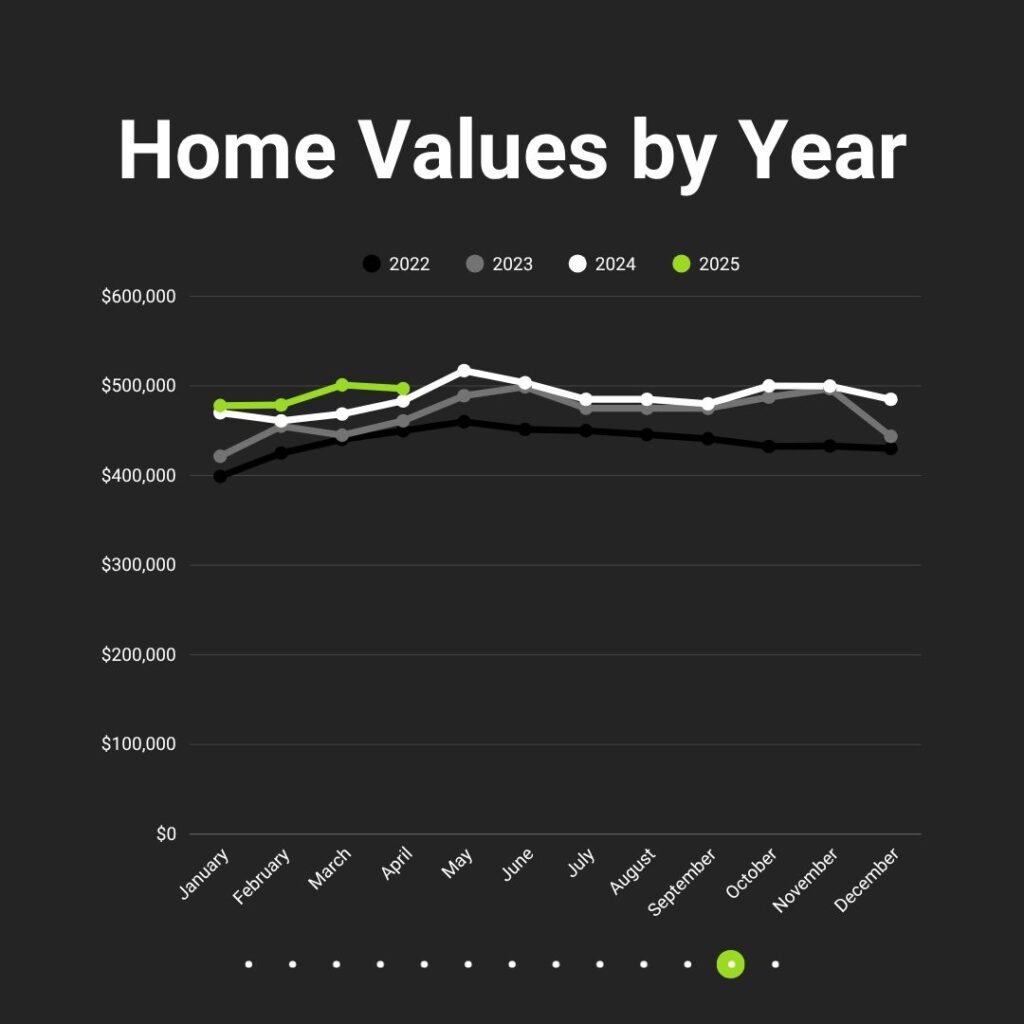

Pricing: Still Climbing but Moderating

- In April, the median sales price reached $497,000—up $17,000 (3.5 percent) from April 2024.

- Year-to-date values in 2025 hold above 2024’s levels, tracking in the $470 K–$500 K range despite seasonal dips.

- While gains remain positive, the pace of appreciation has slowed from last year’s double-digit increases.

Historically, prices crest in late summer and cool into year-end as higher mortgage rates temper buyer budgets.

Mortgage Rates & Buyer Costs

- The 30-year fixed rate sits at 6.92 percent, within a 52-week range of 6.11 percent (low) to 7.34 percent (high).

- Today’s spread versus the 10-year Treasury is 2.55, above the 2005–2019 average of 1.72.

- On a $500,000 loan (plus $400/mo taxes and $100/mo insurance):

- 5.92 percent → $3,472/mo (PITI)

- 6.92 percent → $3,799/mo

- 7.92 percent → $4,140/mo

However, rates remain below last summer’s peaks, offering some relief to buyers.

Buyer Demand & Activity

- Showing traffic (7-day average) ran 25–60 percent above January’s baseline this spring.

- However, activity dipped more sharply over Mother’s Day weekend than in prior years. Likewise, Memorial Day and July 4th weekends usually cause similar slowdowns.

- Closed sales: April 2025 totaled 587 (–1.3 percent vs Apr 2024); March 2025 totaled 501 (–4.0 percent vs Mar 2024).

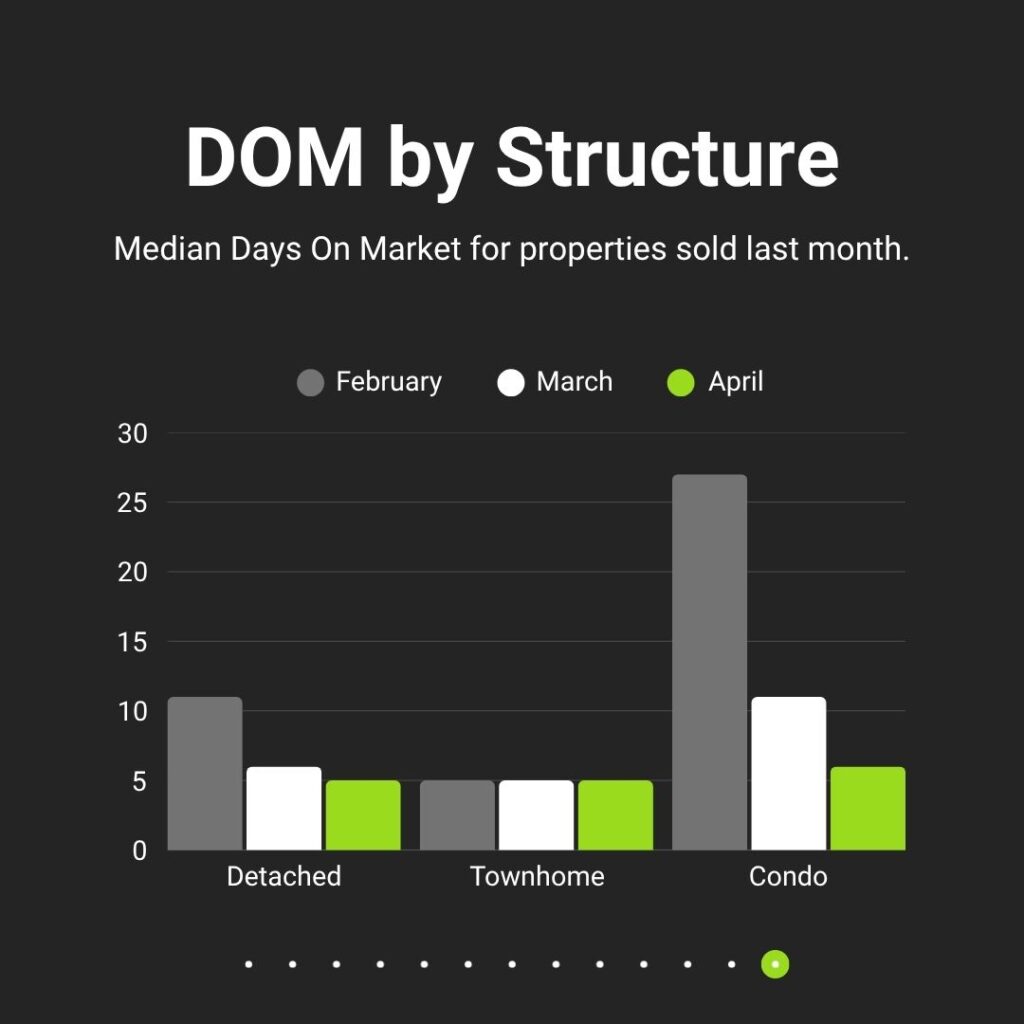

- Days on market stayed tight in April: detached homes and townhomes at 5 days, condos at 6 days. However, expanded supply and softer demand may push these figures higher soon.

Seasonally, traffic and closings often ease into summer. This year’s early slowdown suggests buyers are pacing their searches amid rising rates and more choices.

What This Means for Sellers & Buyers

- Sellers should consider strategic pricing, enhanced marketing, and flexible repair negotiations. Additionally, offering interest-rate buy-downs or seller credits can help your listing stand out.

- Buyers can enjoy more choice with rising inventory in key areas like Pasadena (up 55 percent). Moreover, ask lenders about rate-lock options and creative financing to manage carrying costs.

Looking Ahead

Expect inventory to stay near current levels through June, with dips around holiday weekends. Mortgage rates will be the key wildcard: any drop could reignite buyer urgency, while further rises may extend the current sales plateau. Whether you plan to list this summer or shop for a new home, local expertise can help with pricing, timing and financing strategies.

About the Author

James Bowerman is the founder of Real Creative Group of Douglas Realty. For personalized insights on Anne Arundel County’s evolving market, contact James at 410-971-8004 or James@RealCreativeGroup.com.