As we move into February, the Anne Arundel County real estate market continues to showcase evolving trends that both buyers and sellers should keep an eye on. Here’s a breakdown of the latest numbers, what they mean, and how they compare historically.

Active Listings: A Slight Increase

Currently, there are 555 active listings in Anne Arundel County, marking a 4% increase from last month. Pasadena saw the biggest jump, with inventory rising from 43 to 55 listings. This rise indicates a gradual uptick in inventory, which could provide more options for prospective buyers as we approach the busy spring season.

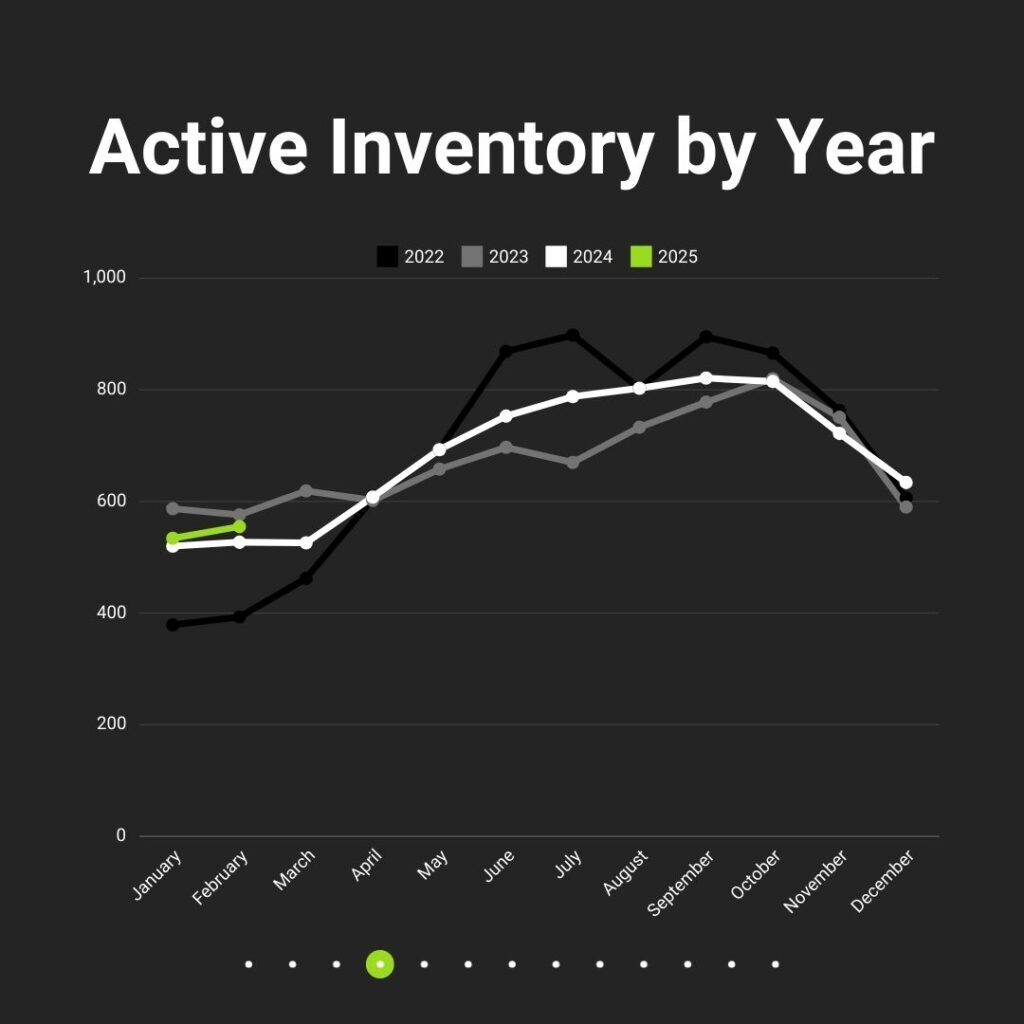

Historical Inventory Trends

Looking at inventory trends over the past decade, it’s clear that inventory levels in recent years have remained lower compared to peaks in 2015-2018. While 2025 started with modest increases, it’s far below the levels seen in the mid-2010s, reflecting a long-term trend of declining housing supply. Seasonal patterns suggest inventory will continue to rise into the summer months before tapering off in the fall.

Inventory by City

Breaking it down by city, the highest inventory levels are in Annapolis (118 listings) and Glen Burnie (76 listings). Other notable areas include:

- Pasadena: 55 listings (up from 43 last month)

- Odenton: 32 listings

- Arnold: 25 listings

This distribution highlights the availability of homes across various price points and neighborhoods, offering opportunities for buyers with diverse preferences.

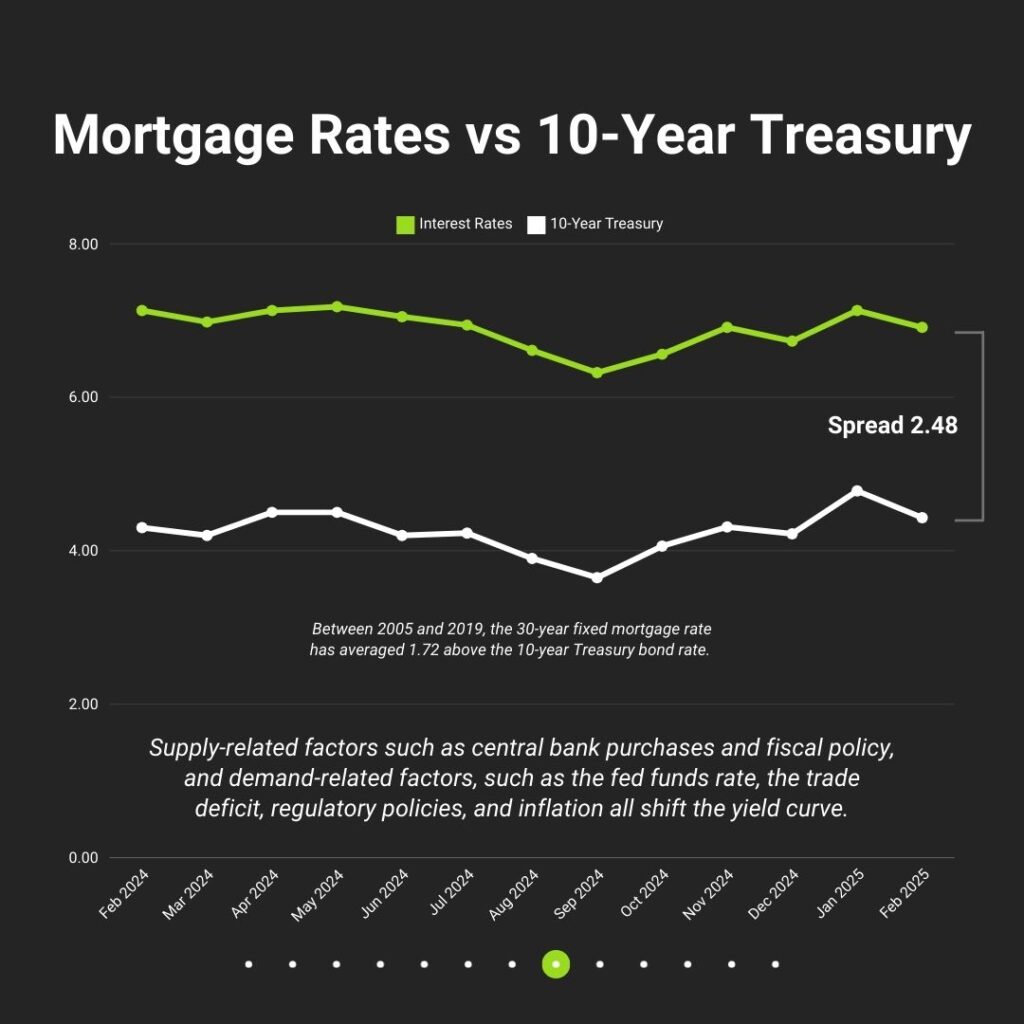

Mortgage Rates: Stabilizing but Elevated

The average 30-year fixed mortgage rate currently stands at 6.91%, reflecting a slight decline of 5 basis points over the past week. However, rates remain elevated compared to historical norms, with a spread of 2.48 points above the 10-year Treasury bond rate. Between 2005 and 2019, the average spread was 1.72 points, emphasizing the current market’s unique challenges.

Payment Comparisons

For buyers, interest rates significantly impact affordability. At the current 6.91% rate, the estimated monthly payment for a $500,000 loan, including principal, interest, taxes, and insurance, is $3,795. A 1% rate change can swing payments by several hundred dollars, emphasizing the importance of securing favorable terms.

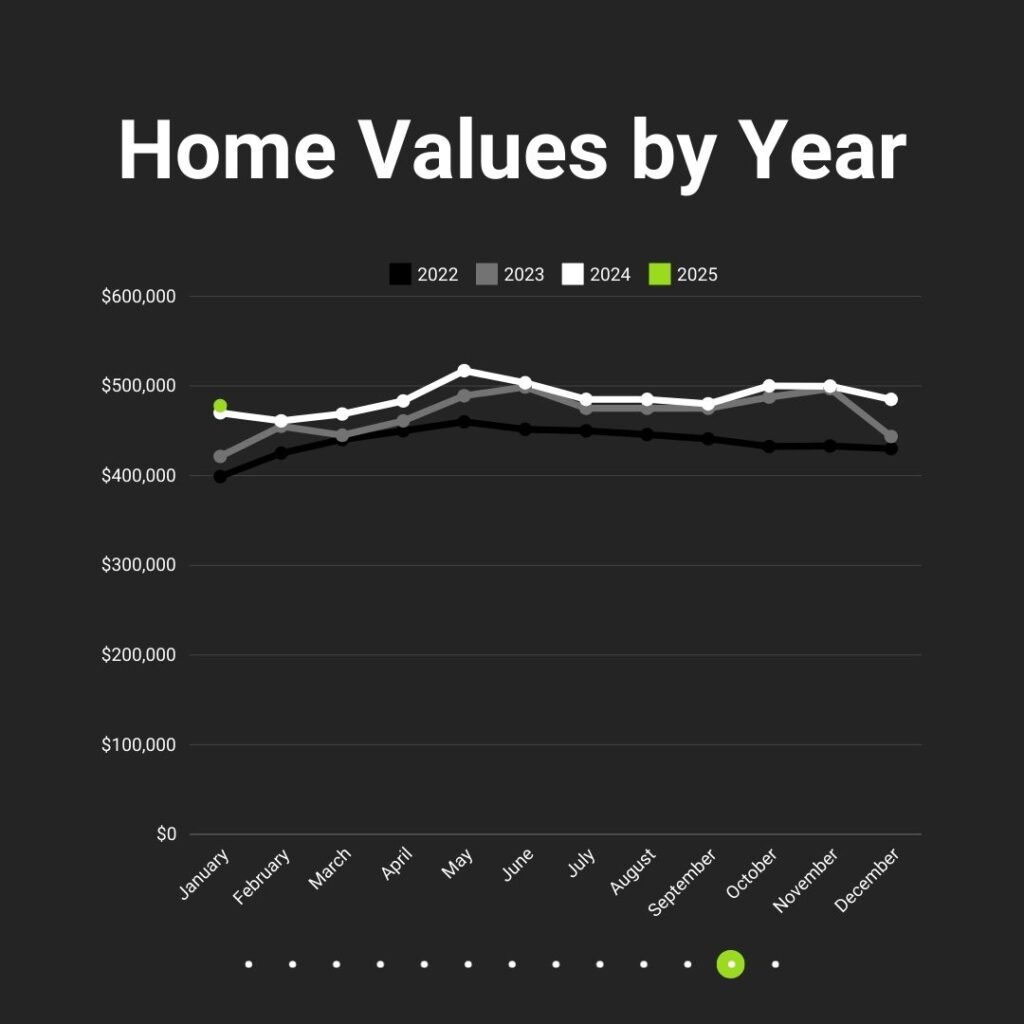

Home Values: Modest Growth

The median sales price of homes in Anne Arundel County is $478,000, reflecting a 1.7% year-over-year increase (+$8,000). This steady appreciation underscores the area’s resilience and desirability, even amidst broader economic uncertainty.

Days on Market by Property Type

Days on market (DOM) has been increasing, along with the number of price reductions. This reflects affordability challenges due to higher interest rates and suggests that housing prices could face downward pressure moving into the spring market. Median DOM by property type is as follows:

- Detached homes: 15 days

- Townhomes: 11 days

- Condos: 14 days

As always, pricing remains key when it comes to selling a home. Properly priced homes are more likely to attract competitive offers and sell quickly.

What Does This Mean for You?

For Sellers:

- With inventory still relatively low compared to demand, it remains a favorable market for sellers. However, pricing your home appropriately is crucial to stand out in a competitive market.

For Buyers:

- While rising inventory provides more choices, higher interest rates mean affordability is key. Work with your lender to explore options and secure the best possible terms.

Final Thoughts

The Anne Arundel County real estate market is poised for a dynamic spring season. Whether you’re buying or selling, understanding these trends is crucial to making informed decisions. If you’re considering a move, let’s connect to navigate the opportunities and challenges of today’s market.

Stay tuned for next month’s update, where we’ll dive deeper into how the spring market is shaping up!