As we enter the heart of the spring real estate season, the Anne Arundel County housing market is experiencing a notable shift. With a sharp increase in inventory and steady growth in home values, buyers and sellers alike are finding new opportunities in one of Maryland’s most competitive markets.

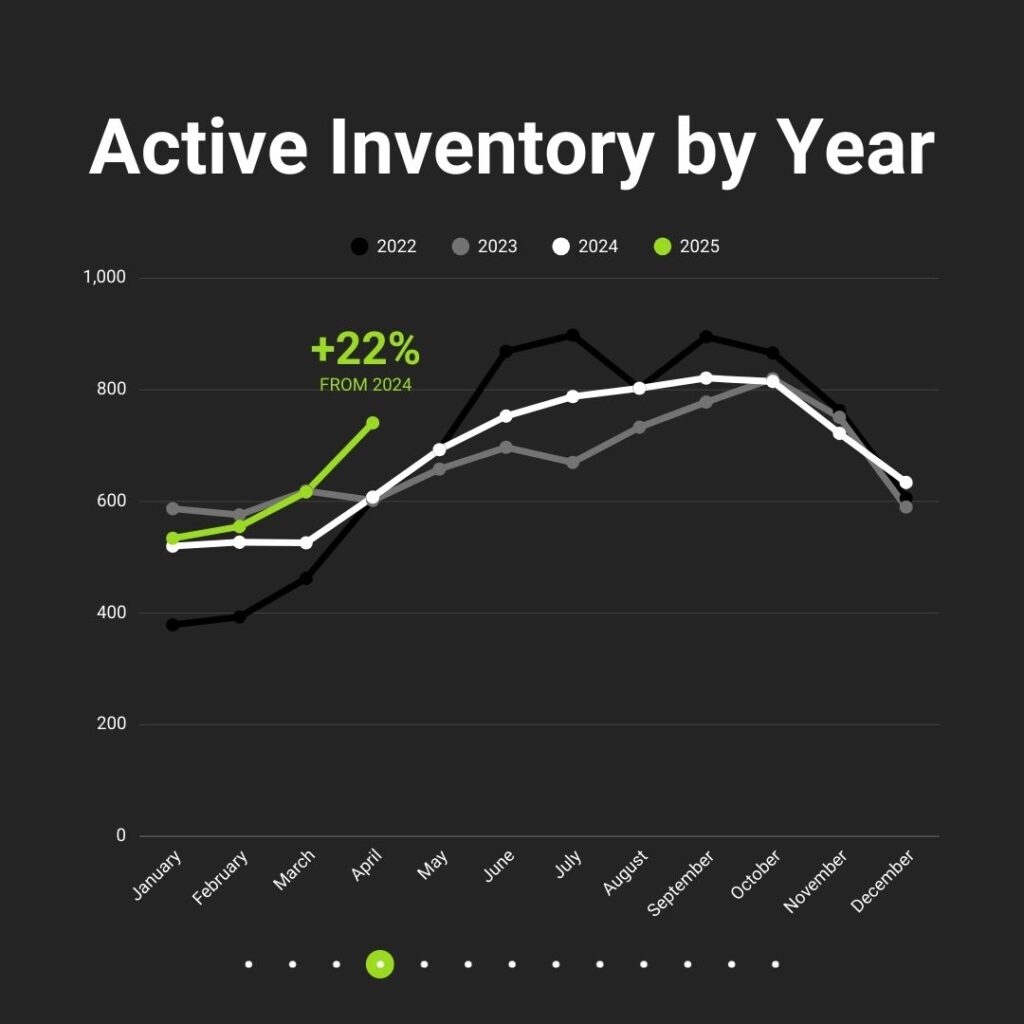

Active Listings Surge to 741, Marking a 22% Year-Over-Year Increase

In April 2025, Anne Arundel County recorded 741 active listings, representing a 20% increase from last month and a 22% increase compared to April 2024. This is the most significant year-over-year inventory growth seen in the past three years, signaling increased seller confidence and a potential easing of the supply constraints that have shaped the market in recent years.

This growth follows a familiar seasonal pattern—spring typically brings an influx of new listings—but this year’s inventory is outpacing previous years. In 2022 and 2023, inventory levels remained comparatively lower during the same period. In 2025, we’re tracking ahead of the curve, giving buyers more options and slightly more negotiating power.

Inventory Distribution by City

The increase in listings is not uniform across the county. Here’s a breakdown of current inventory by city:

- Annapolis: 172 homes for sale

- Glen Burnie: 102 homes

- Pasadena: 72 homes

- Arnold: 41 homes

- Severn: 35 homes

- Odenton: 34 homes

- Severna Park: 22 homes

- Crownsville: 21 homes

Sellers in higher-inventory areas like Annapolis and Glen Burnie may need to price more competitively to stand out, while lower-inventory communities such as Severna Park continue to favor sellers.

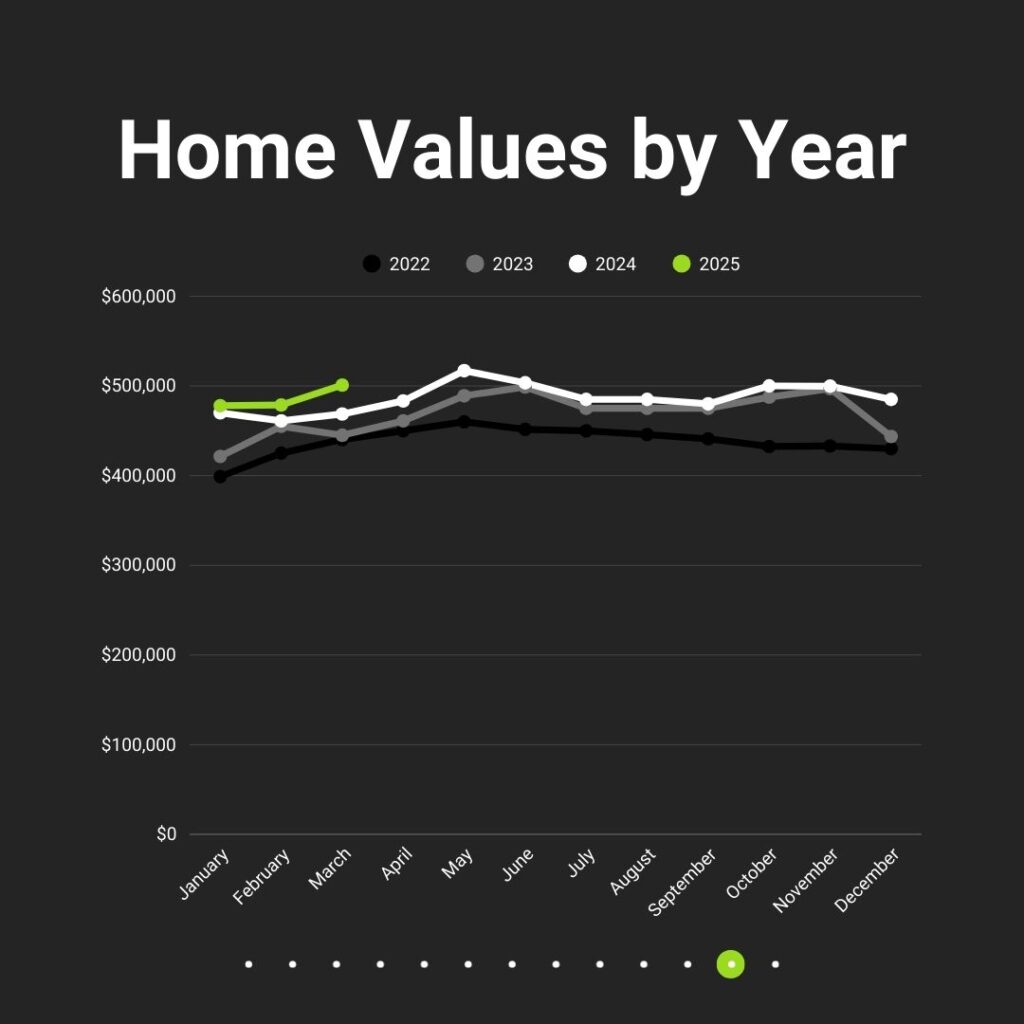

Median Home Price Hits $501,000

The median sales price for homes in Anne Arundel County reached $501,000 in March, representing a 7% increase year-over-year, or roughly $32,358. Home values have remained strong despite market headwinds, driven by sustained demand and limited new construction.

Home value trends also show that prices in 2025 are outpacing both 2023 and 2024, continuing an upward trajectory. This underscores the strength of the local market and the ongoing desirability of communities throughout the county.

Homes Are Selling Faster

With more homes on the market and buyer activity increasing, homes are moving quickly—especially detached properties and townhomes. Median days on market (DOM) fell across the board in March:

- Detached homes: 6 days

- Townhomes: 5 days

- Condos: 11 days (down from 27 in February)

This is a classic sign of the spring market heating up, where buyers are making faster decisions amid increasing competition.

Mortgage Rates and Market Volatility

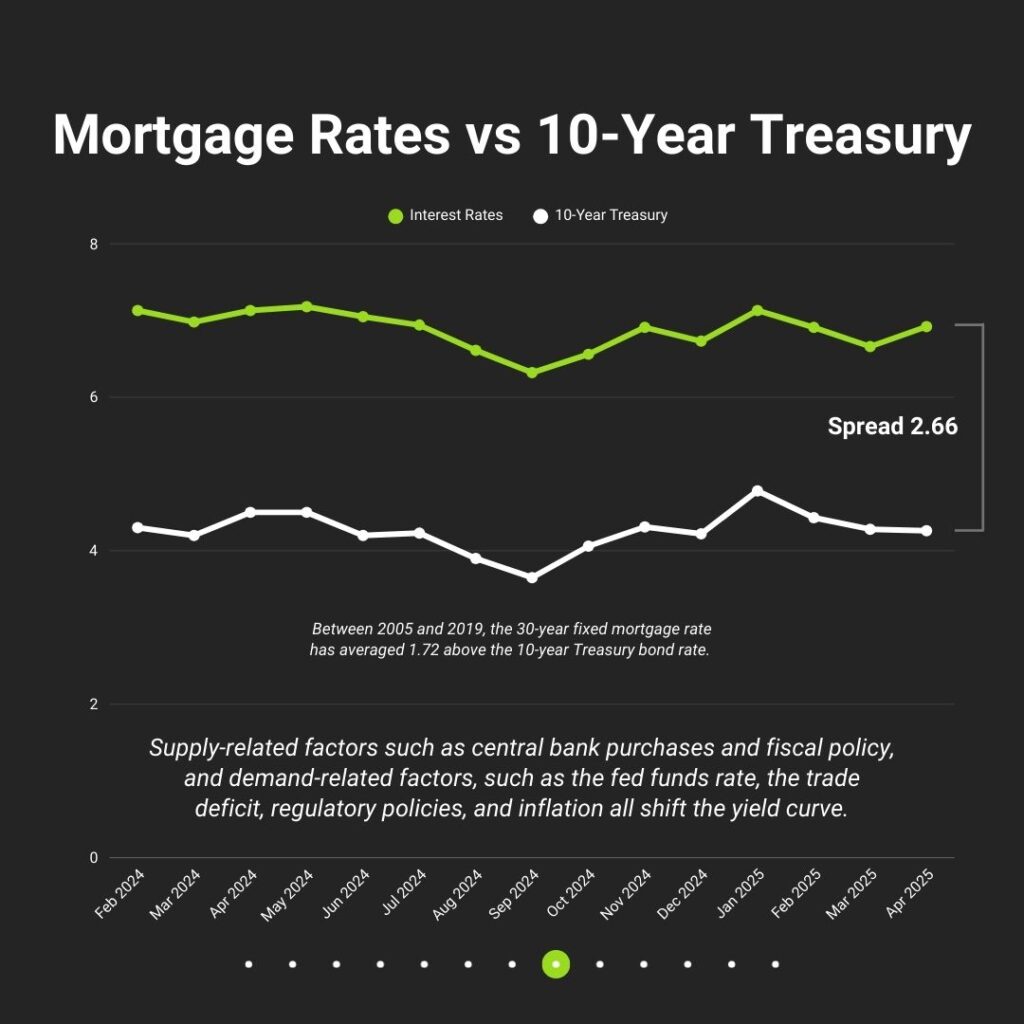

The average 30-year fixed mortgage rate is currently 6.92%, remaining near the upper range of the past year. While this is down from the peak of 7.52%, it’s still well above the historical average.

One key factor keeping rates elevated is the persistent spread between mortgage rates and the 10-year Treasury bond yield. As of April 2025, the spread is 2.66%, significantly above the historical norm of 1.72%.

This widening gap reflects recent market volatility surrounding global tariffs, which have impacted treasury yields and driven uncertainty in the bond market. These economic developments, combined with inflationary pressure and fiscal policy shifts, are keeping borrowing costs high for both homebuyers and investors.

Affordability Snapshot: Payment Comparison

At current rates, affordability remains a challenge for some buyers. Here’s a breakdown of estimated monthly mortgage payments on a $500,000 loan (including taxes and insurance):

- 5.92% rate: $3,472/month

- 6.92% rate (current): $3,799/month

- 7.92% rate: $4,140/month

Even small changes in rates can significantly impact monthly costs, making timing and strategy critical for buyers in this environment.

What This Means for Buyers and Sellers

- Buyers now have more options with rising inventory, but competition is picking up. Locking in a rate sooner rather than later could help mitigate future affordability risks.

- Sellers are entering a more competitive environment and should price strategically, prepare homes thoroughly, and market effectively to attract attention.

Final Thoughts: The Spring Market is Here

The Anne Arundel County real estate market is behaving in line with historical seasonal trends, but with elevated inventory and strong price growth, 2025 is shaping up to be a unique year. Whether you’re considering making a move or simply keeping tabs on your property’s value, understanding where the market stands is key.

If you have questions about how current conditions affect your real estate goals, I’d be happy to help you evaluate your options and build a plan that aligns with your needs.