As we close out the year, the real estate market in Anne Arundel County continues to exhibit some notable trends that both buyers and sellers should be aware of. Below, we break down the latest data to provide a comprehensive snapshot of the market’s current state and offer historical context to guide your real estate decisions.

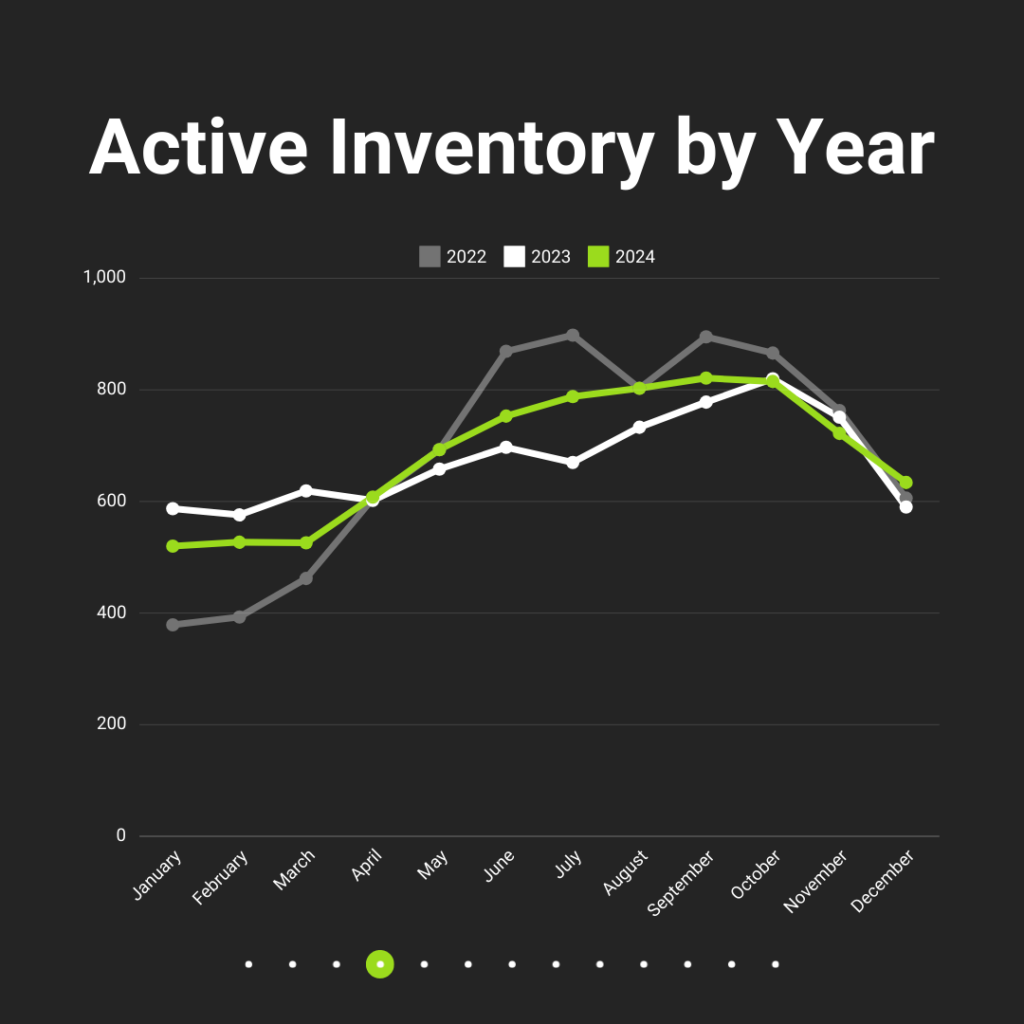

Active Listings

Currently, there are 634 active listings available in Anne Arundel County, reflecting a 12% decrease from last month. This drop aligns with the typical seasonal slowdown seen in the latter months of the year as holiday activities take precedence over buying and selling homes.

Historical data on active inventory from 2022 to 2024 shows a similar cyclical pattern. Active listings generally peak in the summer months and taper off toward year-end. This year’s inventory levels are slightly higher than those seen in 2023, indicating a modest recovery in available housing stock compared to prior years.

Inventory Breakdown by City

Among the cities in Anne Arundel County:

- Annapolis leads with the highest inventory, hosting 136 active listings.

- Glen Burnie follows with 82 listings, and Pasadena comes in third with 78 listings.

- Smaller markets, such as Crownsville and Severna Park, have just 13 and 16 listings, respectively.

These numbers highlight the localized nature of inventory levels. Sellers in cities with limited inventory, like Severna Park, may experience greater demand for their properties.

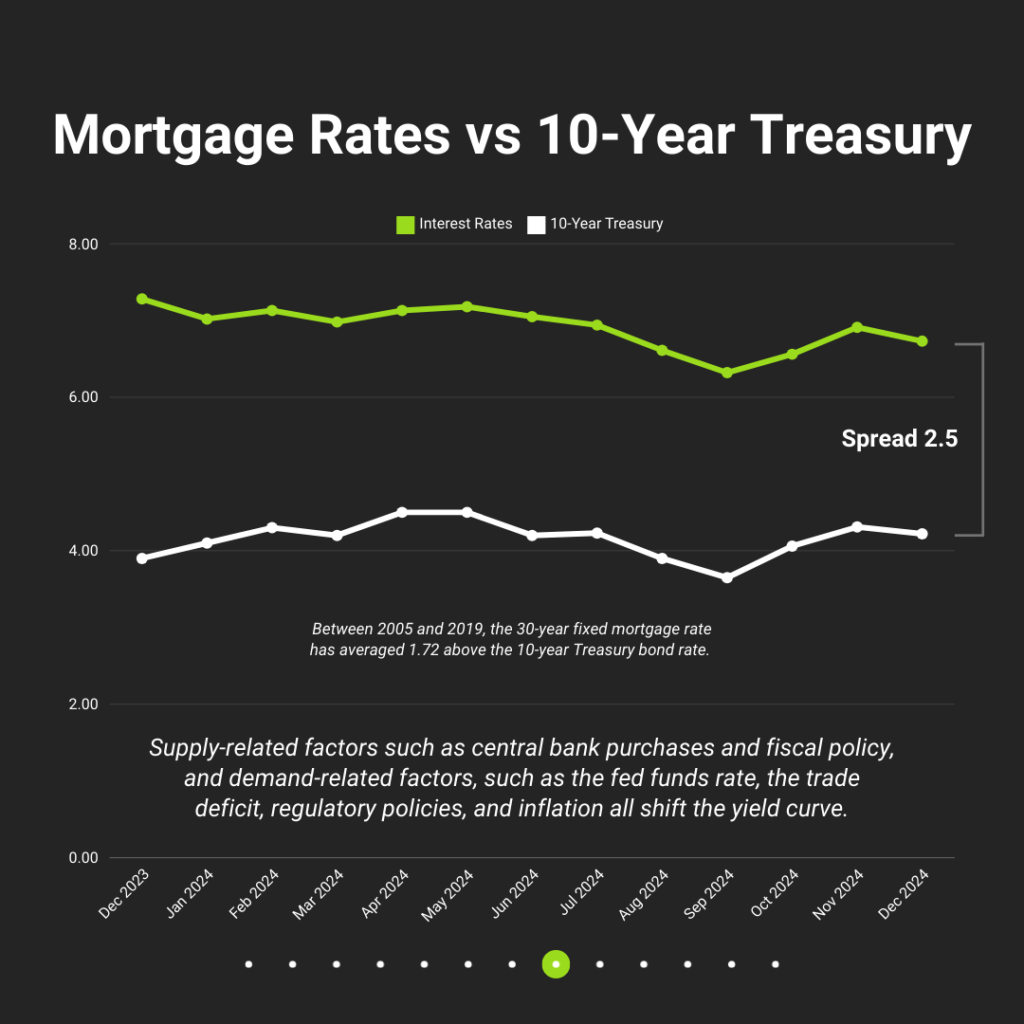

Interest Rates and Affordability

The current 30-year fixed mortgage rate stands at 6.73%, a slight decrease of 6 basis points over the last week. While rates remain elevated compared to historic lows of 2020 and 2021, they are still manageable for many buyers.

Comparing mortgage rates to the 10-year Treasury yield reveals a spread of 2.5%, above the historical average spread of 1.72%. This larger spread is attributed to economic uncertainties and monetary policy adjustments.

For buyers, higher rates impact affordability. On a $500,000 loan:

- At 5.73%, the estimated monthly payment is $3,411.

- At 6.73%, the payment rises to $3,736.

- At 7.73%, the payment escalates to $4,075.

These differences underscore the importance of locking in favorable rates as soon as possible.

Median Sales Price

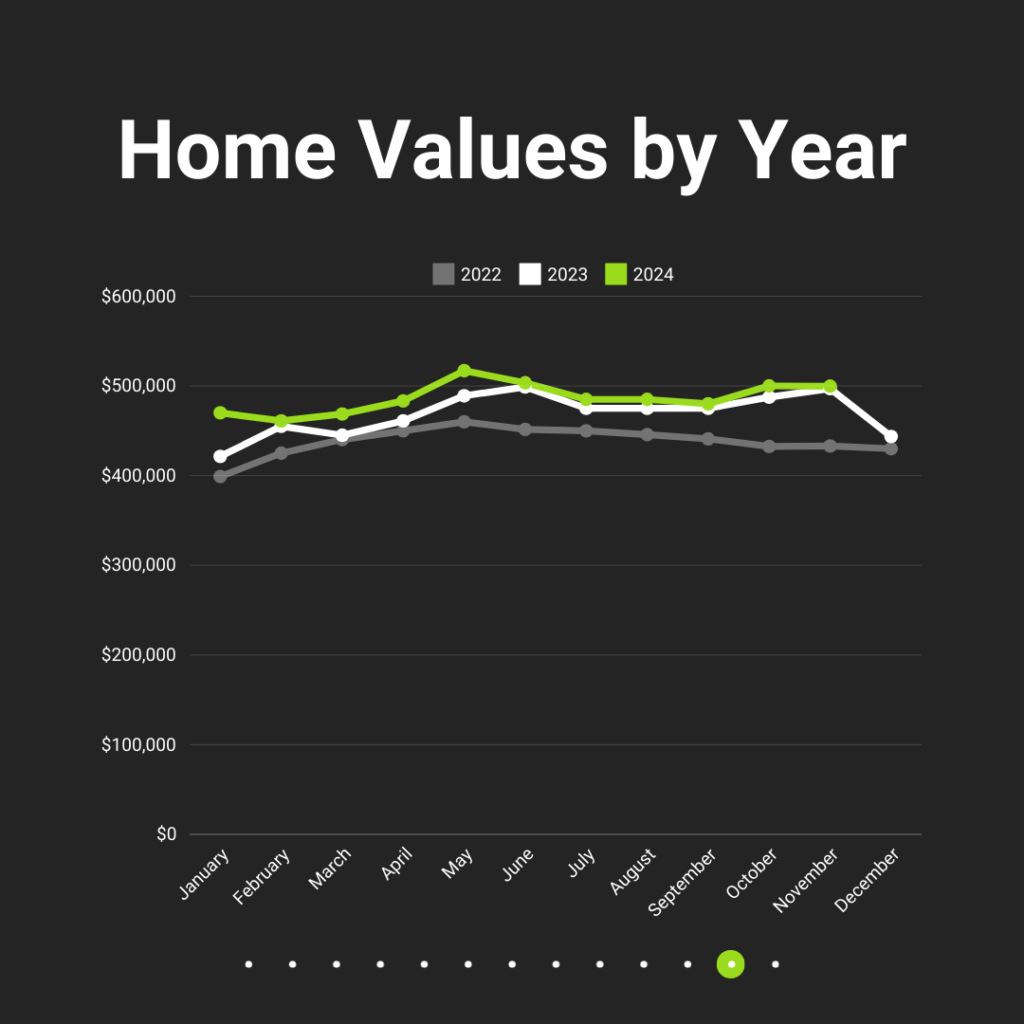

The median sales price for homes in Anne Arundel County is now $499,730, a modest 0.6% increase from last year, equivalent to $2,730. This steady appreciation aligns with the broader trend of gradual price stabilization, as higher interest rates temper the rapid price growth seen in earlier years.

Year-over-year data shows that home values have remained resilient despite economic headwinds, with 2024 values holding steady compared to peaks seen in 2022 and 2023.

Days on Market

The median days on market (DOM) for properties sold last month provides additional insights:

- Detached homes: 12 days (up from 10 in October).

- Townhomes: 6 days (down from 7 in October).

- Condos: 14 days (up from 12 in October).

These increases suggest a slight cooling in buyer urgency, which is typical for the season. However, well-priced homes continue to sell quickly, especially in competitive segments like townhomes.

Key Takeaways for Buyers and Sellers

- Act quickly on desirable properties, especially in areas with limited inventory.

- Explore opportunities in cities like Annapolis, where a larger pool of listings provides more choices.

- Work with your lender to secure the best possible mortgage rate to maximize affordability.

- Price competitively to attract motivated buyers, particularly as the market enters its seasonal lull.

- Highlight unique selling points to stand out in a market where buyers are cautious due to higher interest rates.

- Be prepared for slightly longer market times but know that demand remains strong for well-maintained, appropriately priced homes.

Looking Ahead

As we move into 2025, market conditions will hinge on economic factors such as mortgage rates, inventory levels, and buyer confidence. While some challenges remain, Anne Arundel County’s real estate market continues to demonstrate resilience and stability, making it a promising area for both buyers and sellers.

Stay tuned for next month’s update as we continue to track trends and provide insights to help you navigate the dynamic world of real estate.