As we transition into fall, the Anne Arundel County real estate market continues to evolve, reflecting both seasonal shifts and broader economic trends. In this monthly market update, I’ll break down the latest data, compare it with historical trends, and offer insights to help you navigate today’s market conditions.

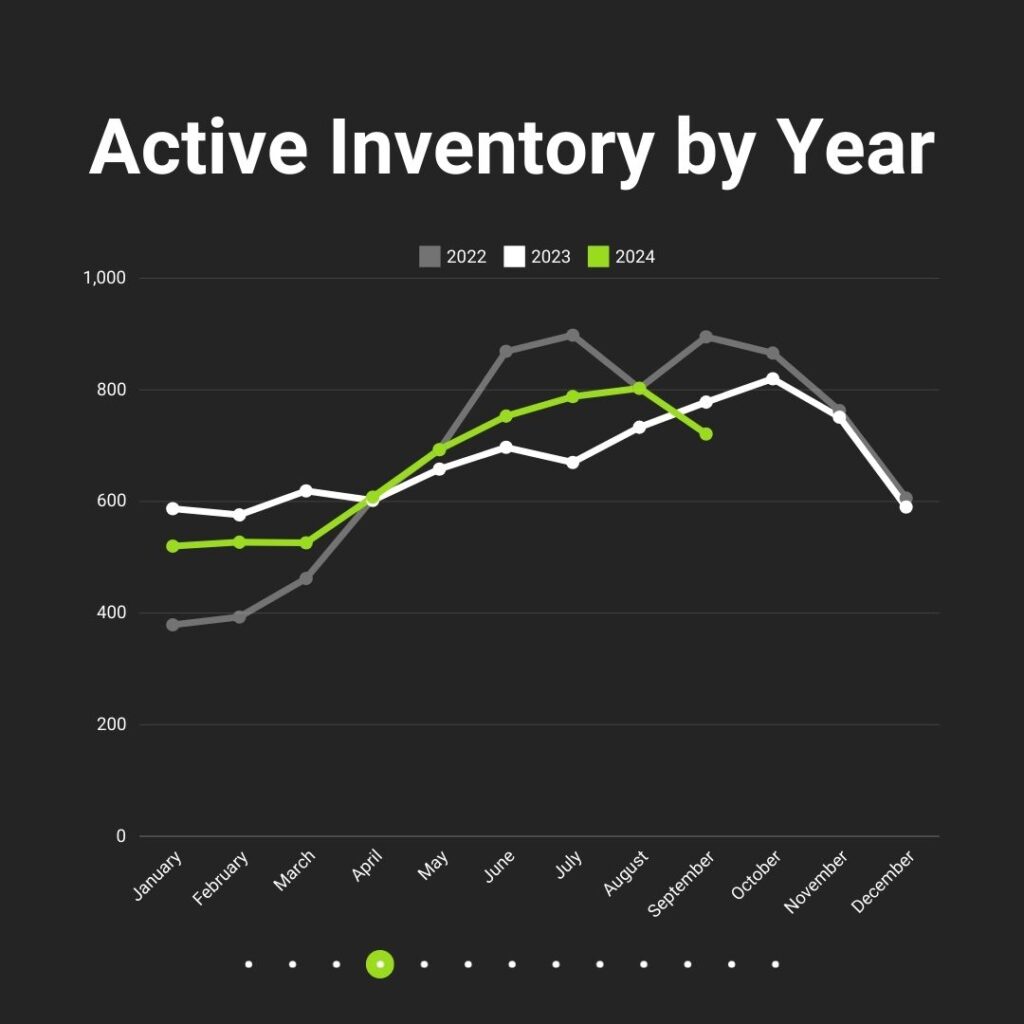

Active Inventory

721 active listings were available in Anne Arundel County, marking a 7% decrease from last year. The inventory continues to be constrained, as the chart shows a steady drop in active listings since the start of 2024. For context, active inventory has fluctuated significantly over the past few years, but this September’s numbers indicate continued tight supply compared to historical levels.

This inventory shortage is partially driven by high mortgage rates, discouraging potential sellers from listing their homes. It’s worth noting that despite fluctuations over the past decade, current inventory remains well below the peaks observed in more balanced markets.

Current Inventory Breakdown:

- Active Listings: 721

- Under Contract: 914

- Coming Soon: 109

With many properties under contract, competition remains fierce for buyers, as available homes are being snapped up quickly.

Mortgage Rates

The average 30-year fixed mortgage rate currently sits at 6.27%, a slight drop of 16 basis points over the past week. Although this is a small relief, the rates are still considerably higher than in recent years, impacting affordability for many buyers. Historically, mortgage rates have typically averaged around 1.72% above the 10-year Treasury bond rate, and the current spread of 2.62% suggests continued upward pressure on rates due to inflation and other economic factors.

For those in the market, this rate change has real financial implications:

- At 5.27%: Estimated monthly payment on a $500,000 loan: $3,267

- At 6.27%: Estimated monthly payment: $3,585

- At 7.27%: Estimated monthly payment: $3,917

Buyers should carefully consider how rising rates affect their long-term financial commitments.

Home Prices

Despite the headwinds of higher interest rates, home values in Anne Arundel County remain strong. The median sales price of homes last month was $486,000, reflecting a 2% increase from the same period last year when the median was $475,000. This is a testament to the strong demand for homes, even with current market conditions.

The historical trend shows that home values have consistently increased over the past few years, demonstrating the robustness of the local housing market.

Days on Market (DOM)

The median days on market (DOM) for homes sold last month provides additional insight into market conditions:

- Detached homes: 8 days

- Townhomes: 7 days

- Condos: 12 days

With homes selling quickly, especially detached homes, it’s clear that buyer demand remains strong despite rising mortgage costs. Homes that are well-priced and in good condition are still moving swiftly.

Historical Cyclical Context

Looking back, the real estate market in Anne Arundel County has shown a cyclical pattern. Over the years, we’ve seen inventory tighten during high-interest-rate periods, similar to the conditions today. Historically, when inventory remains low and interest rates stay elevated, home prices tend to stabilize or increase slightly, as we are seeing now.

However, if rates continue to rise, we may expect a slowing in price growth or a slight dip in sales as affordability becomes a greater issue for potential buyers. On the other hand, should rates decrease in the coming months, we could see a surge in buyer activity.

Conclusion

In summary, the Anne Arundel County real estate market is holding strong despite a slight reduction in inventory and rising mortgage rates. Home values are still on the rise, and demand remains robust, as evidenced by quick sales and competitive bidding.

If you’re considering entering the market, whether as a buyer or seller, it’s essential to stay informed and work with a knowledgeable real estate professional who can help navigate these unique market conditions.

For more updates and expert advice on buying or selling your home in Anne Arundel County, feel free to contact me!